SENATE BILL 218

Over the past several years, the Delaware Board of Accountancy has been working on legislation that would modernize Delaware’s accountancy law. The Board used the Uniform Accountancy Act, the model act written jointly by the American Institute of CPAs (AICPA) and the National Association of State Boards of Accountancy (NASBA) as a springboard and made adjustments it felt necessary to accommodate the needs of the public and the accountancy profession in Delaware. This legislation has been signed by Governor Markell and is effective immediately. Over the next couple of months, the Board of Accountancy will be drafting new Rules and Regulations and preparing new application forms to conform to the new law.

CPA Licensure

Under previous law, when an applicant met the requirements for licensure as a CPA, the Board of Accountancy granted a CPA certificate and permit to practice. The CPA certificate never expires; the permit to practice must be renewed every two years with proof that the holder has taken the requisite 80 hours of CPE. If the holder of a CPA certificate and permit to practice is employed in industry, government or education (i.e., not in public practice), the holder may allow the permit to practice to lapse by not taking CPE and not renewing it at the end of the next reporting period (June 30 of odd-numbered years). Holders of CPA certificates only may use the designation “CPA” as long as it is followed by “not in public practice”. This is called a two-tiered licensing structure, because there are two levels or tiers to licensing.

The Board of Accountancy, in keeping with the UAA and the majority of other states, desired to move to a single tier license where a CPA is treated the same under the law with the same benefits, restrictions and requirements, regardless of where he or she may be employed. To accomplish this, SB 218 phases out the issuance of certificates; however, the permit to practice will continue to be issued under the same licensing requirements currently in place. There is an allowance for those CPAs who have let their permits to practice lapse – until June 30, 2017, they can have their permit to practice reinstated upon completion of 80 hours of CPE.

Under prior law, if a permit to practice had lapsed for more than one year, the only way to obtain a permit to practice again is to meet the licensing requirements currently in place, which includes 150 hours of education and one year of experience under the supervision of a CPA. Since many certificate holders have worked in industry, education or government for many years, having obtained their certificate when the educational requirements were an associate’s or bachelor’s degree, the additional educational requirement (which became effective on August 1, 2012) was a great barrier to qualifying for another permit to practice. Additionally, many in industry, education or government are no longer supervised by a CPA, since they themselves work at the highest levels within their organizations; therefore, there is no CPA supervisor who can sign their affidavit of work experience. Despite the fact that these are highly qualified individuals with years of experience, they are routinely denied permits to practice because of these barriers. The law was never intended to block qualified people from working in their chosen profession.

Under prior law, certificate-holders only are not subject to CPE; however, they may not hold themselves out as a “CPA” without including the clarifying language “not in public practice”. The Board of Accountancy found that this phrase was not clarifying and wanted to eliminate confusion in the public – and within the profession. Under SB 218, whether working in public accounting, industry, education or government, being able to use the CPA designation will require a permit to practice and maintenance of competency as required by the Board of Accountancy.

Use of CPA Designation

SB 218 addresses who may use the designation “CPA”. This is a significant change from prior law.

- Holders of CPA permits to practice may use the designation “CPA”.

- Until July 1, 2017, holders of CPA certificates who at one time held a permit to practice that has since lapsed may use the designation “CPA” provided that it is clearly indicated that they are not holding themselves out as practicing certified public accounting. Until July 1, 2017, anyone who holds a lapsed permit as of June 30, 2016 may have their permit to practice reinstated as long as they complete 80 hours of CPE and petition the Board of Accountancy.

- After July 1, 2017, holders of CPA certificates who held a permit to practice at one time but let it lapse and who did not have it reinstated prior to July 1, 2017 may no longer use the designation “CPA”.

- Holders of CPA certificates only who have never held a permit to practice, may not use the designation “CPA” under any circumstances.

- Holders of CPA permits to practice who no longer provide any type of service or advice involving the use of accounting, attest, compilation, management advisory, financial advisory tax or consulting skills and who do not get CPE may use the designation “CPA Inactive” as long as they have notified the Board of Accountancy.

Reciprocity

Under prior law, there were four ways to get reciprocity:

- Meet all current requirements in Delaware for issuance of a certificate or permit or

- At the time of the issuance of the applicant’s certificate or permit in the other state, met all requirements then applicable in Delaware or

- Has had 5 years’ experience in the practice of certified public accountancy or its equivalent, with such experience having been obtained after passing the examination upon which the applicant’s certificate was based and within the 10 years immediately preceding the applicant’s application or

- Meets the current experience requirement, if an applicant’s certificate was issued more than 4 years prior to the application then the applicant must have completed no less than 80 hours of CPE in the last two years and not have any disciplinary issues.

The Board has encountered many problems applying this reciprocity requirement. The most problematic occurrence is when a CPA from another state moves to Delaware to work. In many instances, that CPA won’t have had a CPA supervising his work within the most-recent 10 years imposed in the law. Therefore, he/she can’t meet the requirements in 1 above because they don’t have supervised experience (and may not have the education requirement). They also can’t meet 3 or 4 above because of the inability to prove supervised experience. They may or may not be able to meet 2 above, but oftentimes the applicant’s license in the other state was issued very long ago and it is overly burdensome to determine what the law was in Delaware at that time. Significant barriers to entry stifle the ability of a qualified CPA to add to the economy and business development in Delaware. The current reciprocity requirements are especially burdensome on small practitioners who wish to relocate to Delaware.

SB 218 simplifies reciprocity significantly. Under the bill, a CPA who has passed the CPA exam and holds a valid CPA certificate, permit or license in a substantially equivalent state or who is determined to be individually substantially equivalent would qualify for a reciprocal permit to practice in Delaware. If an applicant does not meet the substantially equivalent standard, then he/she may obtain a permit to practice by showing that he/she passed the CPA exam, has four years (within the last 10 years) of the type of experience as required under Delaware law, and if the applicant’s certificate, license or permit was issued more than four years ago, he/she must meet the 80 hour CPE requirement.

Ironically, under prior law, if the applicant is duly licensed as a CPA in a substantially equivalent state (Maryland, Pennsylvania or New Jersey) and continues to work out of an office in that state (not Delaware), the CPA can do all of the work for Delaware clients without the need to obtain a Delaware permit to practice under substantial equivalency. So SB 218 was written to ease the burden on qualified CPAs who want to work in an office in Delaware and enable Delaware employers to hire these qualified CPAs.

Peer Review

Delaware was the only state that did not require peer review for firms who perform compilations and audits. The DSCPA and the AICPA do have a peer review requirement for member firms who perform this level of work. Effectively, members of the DSCPA and AICPA are held to a different standard than non-members, even though they do the same work. The Delaware Board of Accountancy determined that requiring peer review for all CPA and PA firms who perform compilations and audits was necessary to maintain the high standards of the accounting profession.

There are a few key points to keep in mind with regards to peer review in SB 218:

- The peer review requirement is identical to the one currently required for DSCPA and AICPA members, so if you are currently enrolled in peer review, you will meet the requirement in SB 218.

- If your firm does not do compilations or audits, you do not need to enroll in peer review and your firms will not be peer reviewed.

- If your firm only does preparation services, you are not subject to the peer review requirement.

- If your firm does compilations but no audits, you may have a CART (Committee Appointed Review Team) review. This is less expensive than a system review.

- Peer reviews are required to be done every three years.

- The Delaware Board of Accountancy will not perform peer reviews. Firms may use Board-approved organizations to perform the peer review.

- This requirement becomes effective for the reporting period ending June 30, 2019.

All firms who do compilations and/or audits and who are not already enrolled in peer review will be required to enroll in peer review starting July 1, 2017. Upon enrollment, the firm will have a peer review done within 18 months. For the firm permit renewal period ending June 30, 2019, all firms who perform compilations and/or audits will be required to show proof that they have been peer reviewed in the prior three years. Similarly, for future firm permit renewals, firms will be required to have had a peer review in the prior three years.

For more information on peer review, please visit https://www.picpa.org/keep-informed/peer-review.

Non-CPA Ownership

The new law includes the ability for firms to have owners who are not CPAs. The Board had been interpreting the prior law to allow for non-CPA ownership; however, the language was confusing and many had been unsure of what is allowed. The Board wanted to clarify its intent that allows for a simple majority of the ownership of the firm to be CPAs.

PA Permits to Practice

Under the new law, no new PA permits to practice will be issued after December 31, 2016. Current holders of PA permits to practice may continue to have their permits renewed with a showing of the requisite CPE and meeting the peer review requirement, if applicable.

Composition of Board of Accountancy

The Board of Accountancy was comprised of four CPAs, 2 PAs, 1 educator member and two public members. The new law changes that composition slightly by increasing the number of CPAs to 5 and decreases the number of PAs to one.

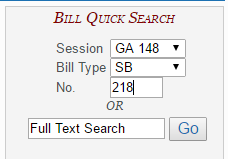

To read the new law, go to www.legis.delaware.gov and under Bill Quick Search, enter SB for Bill Type and 218 for No. as below: